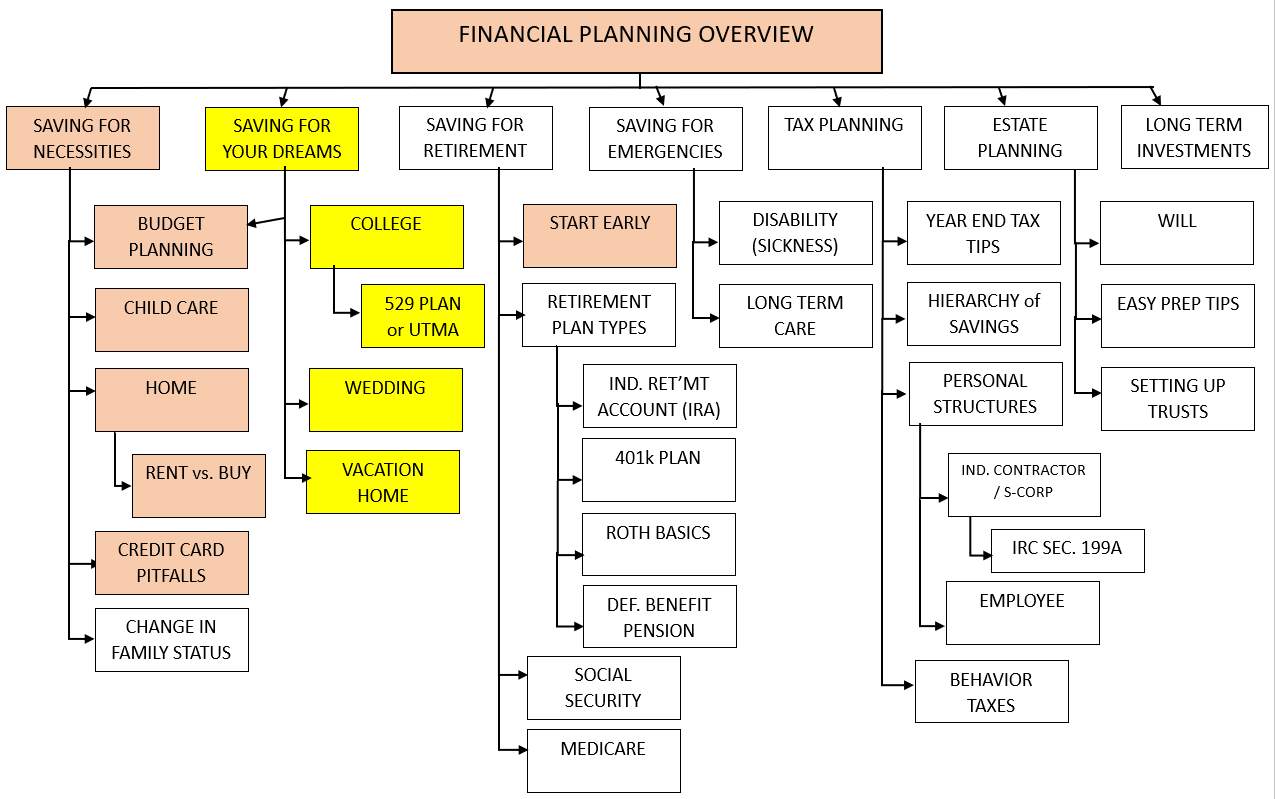

Saving for Your Dreams

Starting is just a pen, a pad of paper and perhaps a bottle of wine away.

We’ve all been there. Those moments when your eyes close, typically after a long sigh where maybe you twist or rub your neck to try and get your head right. You stop what you’re doing and stare in no particular direction and wonder if the extra hours, the extra mile, the extra listening, all the extra effort will be worth it. “IT?” you question, as you lean back in your chair and gently bite your lip, or perhaps as you wipe the sweat of your saturated brow with your shirt sleeve, or maybe as you kiss your now sleeping child on the forehead. What is “IT”!

You look around to see if anyone else just noticed the arrow that just flew through your head! “Holy crap on a cracker!”, you whisper a little more loudly as you realize that this is every bit as important as when you figured out the truth about Santa Claus or how men and women actually do it – that’s a different kind of “it” but you know… do it! You instantly realize that you’ve never really thought about IT. You’ve never planned for IT. You’ve certainly not thought how you’re gonna do IT!

Your mind raced. You felt like a cat who finally caught its tail! Oh, the possibilities! You’ve got to tell your spouse that we need to do IT right away!

So you round up a couple pads of paper, some pens and a bottle of wine and head out on a warm patio evening and set out to define IT. [If you’re single, bring Old Grand Dad or Jim Beam; we don’t want you to drink alone!] After you explain to your spouse the part about an arrow shooting in one ear and out the other without drawing blood, you detail how the two of you have never really planned for anything. Oh sure, you planned for a wedding and looked forward to a life together but where is all this headed? “What do you want to do? What do I want to do? House? Jobs? Kids? Cars? Vacations? Charities? Other?” Then you explain what IT is.

IT is My Dreams. IT is Your Dreams. IT is Our Dreams. We need to make sure that everything we’re working for will be worth IT!

Here’s what you do. There are a hundred variations to this but take that pen and pad of paper and just start writing out your dreams. You can categorize your dreams into personal, professional, and financial or single, couple and family. Individual dreams count as much as family dreams do. No matter how basic or ambitious, write them down on that piece of paper. As the wine empties, write down the whimsical dreams, the fearless dreams, the unreachable dreams. $2 million in a retirement plan? Sure. A four bedroom house in a good school district? Why not? A one on one conversation with the President? Yeah. A once per year girls weekend? Absolutely. Six kids that all go to college? Uhhhh, you better open another bottle of wine. Have fun with it. There are no limits. Fill up that pad of paper if you need to. Then put away that list of dreams and wait a couple months.

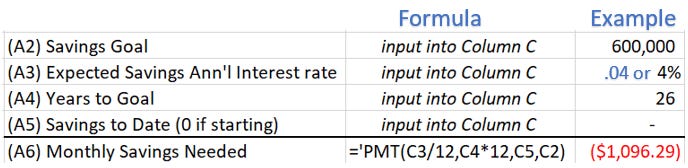

On your next pleasant patio evening, bring out the pads of paper and review those dreams, but this time, prioritize them (Bucket List 1, 2, and 3, or Needs, Wants, and TBD, or 5 years, 10 years, and Beyond). I guarantee that in reviewing those dreams, you will be laughing at many of them but this time, start thinking about when and how. Begin the process of transforming the dream into reality by making it a goal. Put a deadline on each dream like “By 2035” or “Within ten years” or “After the kids graduate high school”. It’s important that you keep moving toward attainment. Two kids in college? That would be 1 Public State University and one 1 Liberal Arts Private School or about $600,000 in potential college costs. Also consider non-financial steps such as moving to a good school district or perhaps home schooling. In the end, you should pare your list of ultimate dreams down to 15 - 20 priorities, all with a cost component attached. To compute the present value cost component, you should use Microsoft Excel and type in the following formulas to compute the present value savings quotient:

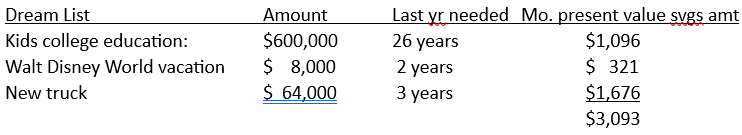

The above example shows the computation for $600,000 in college costs that will be saved for and used within 26 years. Let’s say your dreams include the following:

Given a 4% savings rate, you would need to save $3,093 each month for next two years to meet your expected cost of a Disney World vacation, then $2,772 each month for the following year to buy that truck and $1,096 each month for the next 23 years to pay for those college educations. You’ll need to budget $3,093 for savings each month to meet your short and long term dreams.

Then consolidate the list onto one sheet of paper and hang it on the refrigerator or a spot where you’ll frequently be reminded of your list of dreams / goals.

The only thing left, and this is very important, is to revisit the list each year. Your dreams will change. That “Around the World Cruise” will be replaced by a Showcase Soccer Tournament weekend in Arizona. Old goals will be met and fall off the list and new ones will be added. You WILL suffer setbacks (health problems, lost job) or realize unforeseen windfalls (inheritance, scholarships?) that require adjustments. Planning ahead helps make those unscheduled obstacles act like mere speedbumps. You will find – and I can’t stress this enough - that the little things are the big things and those million tiny steps that you take to reach your dreams will ultimately be “WORTH IT”. You should celebrate some of those “million tiny steps” along the way. Whether it’s a weekend away or perhaps just another warm night on the patio, make sure you reward yourselves when you make measured progress on some of your goals.

So send the kids to their grandparents, get down with Jim Beam, a bottle of wine or a coke and start dreaming.

Link to: Saving for College

Link to: Saving for a Wedding

Link to: Saving for a Vacation Home