Uncle Correction: Still Snoring on the Couch!

Here's an Update on Market Conditions

Let’s look at the current correction and see if it still has more pain in store for the market:

The last update forecast a drop to around 5420 and then 5320. We’ve captured both those targets and the next target is the 10% correction line at 5103. NASDAQ has already hit the 10% correction territory and it figures that the S&P 500 will follow. Since tech earnings, at least the early reporting tech companies, have not shown that their excellent earnings performance over the last three quarters can be maintained and since August is historically a tough month, look for more selling. I have a feeling that there may be a little panic and hence more negative volatility, associated with this correction.

The 100 point drop in the market on Friday was not unexpected but because unemployment numbers were worse than expected and the odds of a recession became very real. As I mentioned before, I felt that the Federal Reserve would relax the Fed Funds rate when the unemployment rate reached 4.3%. Look for the Fed to try reduce rates by a ½% and don’t be surprised if they add another $50 - $100 billion of newly printed cash (M2) into the economy each month in July, August, and September. The Fed will call it many things but it’s an attempt to salvage a stock market prior to the November elections. While I think this is still a correction and the market will somewhat recover with lower interest rates and marginal decreases in inflation, I don’t think we’ll see all time index highs breached again before 2026.

Except for housing starts, economic indicators are anemic with manufacturing, productivity, retail sales, real wages and unemployment numbers all signaling recession. With P/E ratios of the S&P 500 pushing 27 (mean P/E ratios are just over 16), stocks are still overvalued.

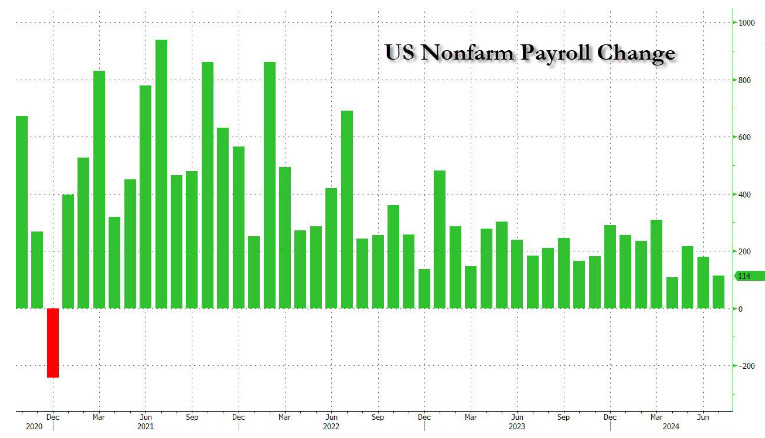

In fact, the unemployment number of an increase of 114,000 new jobs will probably be revised to around 80,000 or 90,000 new jobs and over the last four months, much of the new job growth has been part time or government jobs. In addition, if you didn’t double count those persons who hold two jobs, the actual unemployment rate would be over 6%. As I’ve been saying for six months, the underlying economy is worse than the Bureau of Labor Statistics is letting on. You can link to a good summary on the state of American unemployment: Recession Triggered: Payrolls Miss Huge, Up Just 114K As Soaring Unemployment Rate Activates "Sahm Rule" Recession | ZeroHedge

Before the recent market drop and before Joe Biden removed himself from the 2024 election, investors were showing signs of a Trump trade, where the market was rising because Trump has promised tax cuts and more oil drilling in 2025. However, the naming of Kamala Harris as the presidential candidate and her polling resurgence has reintroduced the possibility that she may win, meaning that her intention of keeping oil prices high by not drilling and her intention of letting the 2017 tax cuts expire after 2025 translate into a tougher market for 2025. As I’ve said before, regardless of the election outcome, I believe 2025 is going to be very tough year on the stock market.

Let me reiterate that if you are over age 55 and perhaps 50, don’t be so eager to get back into the stock market. It is time to be content with 5% Treasuries and other short term fixed income, though I still recommend precious metals as well.

Speaking of precious metals, it appears that the demand for gold and silver is not letting the precious metals market cool off. Silver and gold dropped about a week ago but, do to investors seeking safety, quickly recovered to near $30 and $2500 respectively. It doesn’t appear that even this correction will cool off the demand so both commodities as well as other precious metals may continue higher. You can purchase digital gold or silver with GLD or SLV but if you’re interested in actual coins or metal bars, I’ve had good success with JM Bullion (I have not been paid for mentioning their name.) They sell at about 3% over the spot price at the moment of trade so you know you’re getting a market price. They also have sales occasionally that cut down their commission.

Be cautious.