“Owning a home has been a cornerstone of my life. It’s more than just a building; it's a door to cultivating cherished memories, finding comfort, raising a family and investing in my future. It’s a window to my community and a representation of hard work and the American Dream. I truly enjoy the stability it provides and the pride it brings to my family.”

The American Dream is dying. Less and less people can afford a home. Corporate ownership of single family homes is accelerating. While there are other causes in home affordability, the prime reason is that the federal government has chosen to reward corporate landlords at the expense of individual homeownership. More and more individuals are being prevented from accumulating wealth, thereby shrinking the middle class. Private property and home ownership is highlighted in the Constitution as a hallmark of American society but the rich are getting richer, the poor are getting poorer, and the government seems content with this fact.

Housing is essentially a demand and supply equation. Supply exceeds demand, prices drop. Demand exceeds supply, prices go up. However, there are other factors that affect home prices.

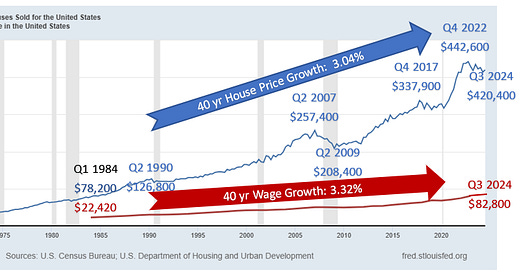

For the most part, over 40 years, the average price of a home kept pace with average U.S. wage growth. There are regional differences. For instance, over 40 years in California, Median wages rose 3.91% while median home prices rose 5.25% per year. New York City, Hawaii, Virginia, and Chicago are other areas where the increasing prices on homes have outpaced wage growth by more than 1%. Housing is unaffordable for a record half of all U.S. renters and according to Unison, it takes 14 Years for the average renter to save a 20% home down payment for a median priced home; in Los Angeles, it takes 43 years! The price of homes has come down in the past two years but because interest rates have gone up, it still hasn’t helped home affordability.

The real disparity has come more recently. Since the beginning of the COVID in Q1 2020, just four years ago, wages have increased approximately 4.4% and home prices have increased about 7.5% each year. Younger Americans have become discouraged or perhaps realistic as 51% of Americans feel that they will never own a home.

According to an NBC News report where housing affordability is worst and costs are highest in the U.S., 60% of Americans who make the median income in a region can afford a home. Five years ago, it was 90%! The American Dream is becoming shrouded in fog and with elevated long term interest rates showing no sign of easing, even affordable regions like Pittsburgh, Indianapolis, El Paso, and Oklahoma City are becoming less so.

Why has purchasing a home become its own hamster wheel for some Americans?

SOCIAL CHANGES

Millennials (born between 1981 and 1996) are not getting married until later in life and this same group is mired in student loan and other debt, making the purchase of a home less affordable. Stricter lending standards from banks have also contributed to the lethargic home sales among Millennials.

SUPPLY OF HOMES

Home building is the foundation of our economy. New homes increase construction jobs, which increases commerce in a new area, which begats commercial building to address consumer demands, which increases the demand for more new homes and the cycle continues.

New Homes built each year average 1.45 million units each year. While current home building is in the vicinity of where it should be, the homebuilding industry is still trying to meet the demand created from the under-supply of homes built from 2009 through 2020. Pent up demand from the sub-prime mortgage crisis in 2009 created a 51% boost in median home prices by 2018. After COVID hit and people started working from homes, an additional price explosion of 49% occurred from 2020 – 2023. It’s no wonder that it takes so long to save down payment!

The obvious solution is to build more homes and increase housing supply so that prices will drop. Removing onerous environmental testing, relaxing building standards on such things as in house sprinklers, solar requirements, or minimum lot requirements, as well as expediting the permit process can all affect home prices.

In an attempt to open up land for more home building, Donald Trump has spoken of opening portions of the 640 million acres in federally owned land to developers for purposes of building houses.

However, there is one factor that has substantially increased over the last six years, resulting in more concentrated ownership of private property and outsized price growth in home prices. Corporate ownership of single-family homes is rising and if the American Dream is to be realized by more Americans, the best thing that can be done is to reduce the effect that corporations have on home prices.

According to Congressional Research Service, there were 16,520,000 residential single family homes owned by corporations in 2020. This constituted about 20% of all U.S. single family homes. In 2018, with the passage of the Tax Cuts and Jobs Act (“TCJA”), corporate ownership of single family homes accelerated to investment firms with the intent of renting out these properties. This percentage has increased each year so that in some states, as much as one-third of all properties sold are to corporations who specialize in renting homes. Does this increase the prices of homes? Absolutely!

Increase demand from corporate buyers, increase the price. If you took away one-fourth of the demand, prices would not have increased by 49% over three years. (I estimate that prices would have increased by 5 ½ to 6% per year and the median price of a home would now be around $380,000, rather than $426,000.) Why has corporate ownership of homes exploded? Depreciation expense deductions.

DEPRECIATION EXPENSE

Current laws allow investment firms or even small landlords, to depreciate home structures (about 80% of any home purchase, you cannot depreciate the land portion). Using a median priced home of $440,000, that means that investment firms can depreciate the price of the structure over 27 ½ years, or about $12,800 in write-offs each year. Many investment firms gain accelerated depreciation by depreciating carpet and flooring, plumbing, window treatments, and landscaping under what is called cost segregation depreciation, which allows for depreciation of 3, 5, or 7 years depending on the item. Instantly, your $12,800 in write offs becomes $16,000 - $20,000 in annual deductions. Add this to the rent charged on this home, an investment firm can realize an annual return on investment of at least 12% each year!

Here’s the kicker. While the individual homeowner may never realize a capital gain on the sale of their home, the corporate landlord realizes the year to year cash flow tax benefits regardless of a capital gain. And while many middle class individuals pay 25 – 30% in personal income taxes each year, the corporation pays 21% on their profits! With Donald Trump stating that he wants corporate taxes to drop to 17%, it is very conceivable that corporate ownership of homes could amplify to 40% of all homes sold! Because corporate landlords are guaranteed a 4 – 5% return just from depreciation expense, the risk of purchasing single family homes is next to nothing as they slowly corral the housing market, charging higher rents (rents have increased nearly 40% since 2020) that prevent individuals from accumulating down payments! Federal and state governments are providing tax breaks for the wealthy and slowly ripping the American Dream of owning a home away from more and more Americans.

[It should be stated that all depreciation expense is offset by the value of the property when the owner sells. Because corporate landlords never use the house for personal use, they do not qualify for the $250,000 one time capital gain tax exclusion used by individual homeowners.]

PICKING WINNERS AND LOSERS

If you’ve invested in companies like Invitation Homes (dividend nearly 8%) or set up an LLC to own homes and take advantage of these tax benefits, that is smart investing but when the government is assisting mostly wealthy individuals at the expense of the middle class, that is government picking winners at the expense of others. When there is such a distinct advantage for wealthy corporations, (remember, it takes 14 years for a couple to save a down payment on a house), it’s almost like the government wants you to chase your dream forever! It’s almost like the federal government wants you to rent forever!

CORPORATE LANDLORDS REJOICE!

Investment in the home market went into overdrive in 2020 after the government locked down the nation for COVID infection protection. When businesses began moving out of commercial offices in 2020, corporations like Invitation Homes, Vanguard, American Homes 4 Rent, State Street, and Black Rock switched their investments from commercial property to residential property for several reasons:

The commercial property market became very uncertain as increased vacancies began impacting both cash flow and profits.

Labor moved from the office to home and workers desired homes with office space, increasing the demand on home prices. (See price increase from 2019 to 2023.)

The depreciation expense on residential real estate is realized over 27 ½ years while commercial property depreciation is realized over 39 years. Why buy a $10 million commercial property and generate over $256,000 in annual depreciation write-offs when you can buy 25 residential properties for $400,000 each and receive a collective depreciation of at least $364,000 each year? With the reduction in corporate income tax, the realized profits were even greater!

In late 2017, Congress passed President Trump’s prized tax reduction law, the Tax Cuts and Jobs Act (“TCJA”). This law accelerated depreciation expense, including segregated depreciation, on all properties, especially in the first few years after purchase and was a prime reason why corporate ownership of single family homes accelerated. The law also reduced corporate income taxes to 21% and reduced individual income tax rates across the board. This law lapses on January 1, 2026 without action by Congress. While the corporate tax rate is permanent past 2026, most other provisions, including the depreciation expense and individual income tax reductions will lapse.

As long as these rules are in place, there is no reason to think that home prices will not continue to be inflated and there is no reason to think that the percentage of individuals who can afford homes will continue to decline. There is no reason to think that the middle class won’t continue to shrink. If you own a home, your next sale may not be to a lovely couple trying to get a jump on life but rather to a faceless entity that is going to use an algorithm to determine the most advantageous rental rate every ten minutes. If you’ve ever seen It’s a Wonderful Life, it’s the difference between the friendly residents of Bedford Falls and the struggling, cranky renters of Pottersville!

You might ask: why does a house or building need to be depreciated? I understand depreciation on a vehicle or farm equipment that loses value as soon as it’s taken off the lot but outside of Detroit two decades ago, when does real estate actually drop in value? Real estate actually weathers inflation better than other investments. When it comes to owning houses, why shouldn’t everyone have the same opportunity? Buy a home, maintain the home, pay the mortgage, sell the home, report your gain and move into a new home.

I don’t like taxes and I understand that tax inequity is prevalent throughout the tax code but this one now favors the wealthy landlord over the homeowner who has saved for years to reach their dream. Depreciation expense is a product of government largesse, manufactured out of thin air and given to predominantly wealthy individuals as an advance gift on the ultimate capital gain that properties almost always generate.

Individual homeowners are at a disadvantage and its beginning to erode the very hallmark of being an American; home ownership. This has to change.

SOLUTION TO INCREASE HOME AFFORDABILITY

In order to preserve the American Dream for all Americans by stabilizing prices, help preserve the middle class, and spur construction of more homes, Congress should consider:

Modify the TCJA so that individual income tax rates are made permanent but let other provisions within the law lapse on January 1, 2026.

Change the federal law and change the depreciation rate on single family homes from 27 ½ years to at least 75 years.

Remove segregated depreciation on carpet and fixtures for single family homes.

These changes will reduce the arbitrary government incentive of 3.6% - 5% each year to around 1% and reduce the monetary disadvantages that homeowners currently have when buying a single family home. Corporate landlords still receive their benefit, but when they sell the rental home rather than each year. I expect that this change would force corporate property owners to analyze their internal rates of return, move to the higher depreciation deductions of commercial property and allow more individuals access, as the Constitution guarantees, to the right of “pursuing happiness”.

I have sent this letter to my Congressman and both Senators and hope that they fight for the American Dream.

Chris.....great article. Keep em coming. I support removing the depreciation from single family residence AND multi family residence and Commercial building. Homes/buildings do not get "used up" in the course of business. If the business owner is unfortunate and the value of the building decreases, they will recognize the loss when they sell. This will cause all housing prices to decrease as corporate ownership with decrease (you made this point). Cost segregation should be allowed for paint, carpet and other items that get used up in the course of business.